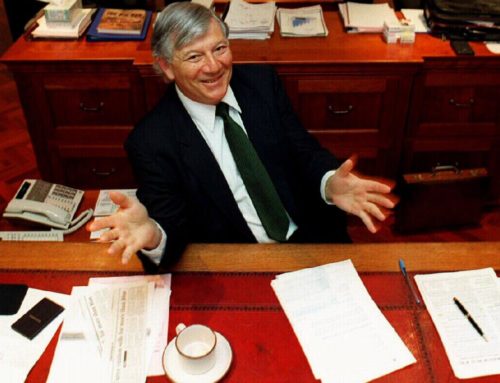

Interview: Gudmundur Fridriksson

What explains the exceptional growth of the property market in Papua New Guinea?

GUDMUNDUR FRIDRIKSSON: Since 2007 PNG has enjoyed considerable economic growth on the back of mining and commodities. This has since been followed by the construction of the PNG Liquefied Natural Gas project. There’s been a lot of developer activity to address the housing supply shortage and capitalise on lucrative returns.

Even so, supply is constrained and affordability remains an issue. Furthermore, the rush to develop has meant little innovative thinking has gone into what has essentially been the replacement of old stock with new. For developers, this all means there are plenty of opportunity ahead.

Where is growth likely to come from in the future, considering the saturation caused by the additional capacity?

FRIDRIKSSON: PNG has matured as a market, with a growing middle class and discerning customers that demand more in the way of lifestyle. The dominant paradigm for so long has been compound living, which has meant locking residents in behind high fences and security guards. Looking at Port Moresby, the city is transforming. The port is being redeveloped and the waterfront is being embraced, with free access from the Central Business District all the way around Paga Hill to Ela Beach. This is going to set the tone for all future development, be it residential, commercial or open space. Other cities will follow suit, breaking the old paradigm, and embracing a more open way of life. Therefore, the next phase of development activity will be focused on urban renewal. Led by public and private efforts to develop new and vibrant focal points, future developments will be supported by the demand for an “X factor”. This means creating quality stock with good amenities.

How should the PNG real estate market evolve to meet the demands of new investors, and what form should these changes take?

FRIDRIKSSON: The real estate market has reached a level of maturity in PNG that demands better planning. People should be thinking about how to move forward over the next 20 years, instead of taking short-term speculative actions. One aspect of Paga Hill Estate that illustrates this is our aim to be the first to operate under strata title legislation. This is now a foundational expectation for investors, and is critical to ensure security of title over individual apartments, as well as effective administration and property management.

PNG is now attracting the attention of serious investors. These are entrepreneurs with real expectations, backed by large corporations with the financial muscle to support quality property development. In my opinion foreign investment must go hand in hand with creating a lifestyle that will result in people bringing their families to live in PNG and having their children study in local schools, instead of keeping them abroad.

Similarly, the real estate market will also need to focus internally. We have a growing middle class with serious buying power, and there will be strong demand for developments that are not just in their price range, but also offer more in the way of lifestyle. I am very positive about what is being achieved in Port Moresby: road infrastructure upgrades and general city beautification initiatives, development of Paga Hill Estate and the overall redevelopment of the waterfront. Other cities are similarly investing heavily in new road networks and infrastructure, which are opening up new areas for investors and developers. For the first time, there is an atmosphere of real collaboration between stakeholders to achieve win-win outcomes for shareholders, towns and cities.

This information was originally published by Oxford Business Group (OBG), the global publishing, research and consultancy firm. Copyright Oxford Business Group 2016. Published under permission by OBG. For economic news about Papua New Guinea and other countries covered by OBG, please visit: http://www.oxfordbusinessgroup.com/economic-news-updates